Installment Sale of an Asset

AVOIDING THE LARGE PENSION TAX TRAP

August 18, 2017An Installment Sale of an Asset Can Defer Payment of Gains Taxes & Provide Proceeds of Sale Today

A question I am regularly asked in my practice is whether it is possible to reduce or delay payment of capital gains taxes on the sale of real estate without having to undertake an Exchange under IRS Code Section 1031. The answer is yes, and you may be able to defer payment of the capital gains tax on the sale of other assets as well, such as the sale of your business.

Under IRS Code Section 453, it is possible to defer the capital gains owed on the sale of an asset for up to 30 years, but some methods of implementing deferral are smarter (maybe something other than smarter? Don’t want to make them feel stupid) than others. In this writing, you will learn the smartest method currently available to taxpayers for the sale of both real estate and business stock – one that is sure to at least make you reconsider how you plan to sell a high gain parcel of real estate or a family business.

Scenario

Let us start by imagining an LLC made up of four partners located in Beverly Hills, CA is being sold for $20,000,000.00. There is an interested buyer but the seller is concerned and possibly reluctant to sell due to the amount of capital gains that will come due as a result of the sale. The lawyer and CPA are approached to develop a solution, for which the lawyer is familiar with the strategy that DKI uses. The cost basis of the company is $2,000,000.00 and there is an outstanding loan balance of $400,000.00. The State of California’s tax rate is 13.30% and additional transfer tax is 0.11%. The Federal tax rate is 23.80% so the seller’s total tax exposure is 37.21%.

The Lawyer covered the generalities with the seller and the CPA and then called DKI with additional questions. DKI provided answers to the lawyer’s questions and then referred him/her to a third party law firm for expert advice. The lawyer, expert legal counsel, the CPA, and the Seller discussed to options for which the seller came to the conclusion that this was the best option they could utilize to retain as much cash as possible. The comparative net proceeds from each method of sale is illustrated below:

| Standard Sale | |

| Sales Price | $20,000,000 |

| Book value (basis) | (2,000,000) |

| Taxable amount | $18,000,000 |

| State Tax Rate | 13.30% |

| State Transfer Tax Rate | 0.11% |

| Total State Tax on Sale | (2,413,800) |

| Federal Tax Rate | 23.80% |

| Total Federal Tax on Sale | (4,858,484) |

| Net After Tax Proceeds | $12,727,716 |

| Loan balance | (400,000) |

| Excess depreciation | |

| Net Proceeds | $12,327,716 |

| Installment Sale Method | |

| Sales Price | $20,000,000 |

| Loan to sales price | 95% |

| Loan amount | $19,000,000 |

| Origination fee | 1.00% |

| Title fee | 0.50% |

| Cost of issuance | (285,000) |

| Net loan proceeds | $18,715,000 |

| Loan balance | (400,000) |

| Net proceeds | $18,315,000 |

| Gross retained | $18,315,000 |

| Third Party Advisor | __________ |

| Net post third party costs | $18,315,000 |

| Additional Net Proceeds | $5,987,284 |

What is an Installment Sale?

An installment sale is a method in which an asset can be sold for value, whereas the payment for asset occurs over an extended period of time. This type of sale method functions under the Internal Revenue Code Section number 453.Tax code section (453) was drafted to specifically address installment sales and has been in effect since the establishment of the tax code in 1913.

The difference between the traditional installment sale and the installment sale illustrated above is that a monetized loan based on the principal amount is provided to the seller immediately after the sale. Under the traditional installment sale, the capital gains tax is not owed until principal under the financed sale is received. So, for example, if the installment sale involves payment of ten percent (10%) of the principal for ten (10) years, the seller would pay ten percent (10%) of the capital gains tax owed on the sale each year for ten (10) years; the tax is incurred as principal is received.

In a smartly executed installment sale, the seller does not have to wait for payment of the principal for thirty (30) years (or whatever the deferral period is) in order to defer the payment of the capital gains tax for thirty (30) years. The seller, by way of a monetized loan from a third party lender, is able to receive almost all of the principal on the sale immediately and still not have to pay the capital gains tax on the sale for up to thirty (30) years!!!

Steps & Purpose of Each Step

At the outset, authority for this transaction was provided on August 24th, 2012, when the Internal Revenue Service via the Office of its Chief Counsel issued Memorandum #20123401F which, in substance although not quoted, approved tax deferral for an installment sale under Section 453, even in instances where the installment sale transaction was/is combined with a monetizing loan from a third party lender as described above. The steps of this transaction are as follows:

- The first step is Loan Underwriting: Initial transaction assessment, structuring, risk mitigation, advisor interfacing, and qualification for submission to a qualified Dealer (the “intermediary”). Estimated time for this process is two (2) Business Days;

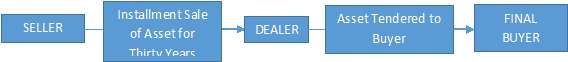

- Installment Transaction: Once the Dealer decides to go forward based upon the aforementioned Underwriting, the Seller sells its asset to a qualified Dealer by virtue of an Installment Sale Contract (hereinafter referred to as the “Installment Contract”). The Installment Contract will provide payment of interest only to the Seller for thirty (30) years, with a balloon payment of the entire amount of principal to be paid from the Dealer to the Seller in year thirty (30). The Dealer will then sell the asset to the Buyer for a cash payment, and the Buyer will take ownership of the asset and is finished with their end of the transaction;

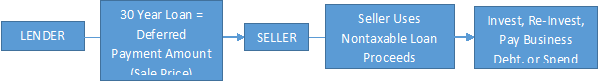

- Loan Transaction: Seller is then offered a loan from a financial institution based upon the value of the principal owed on the Installment Contract in Step 2, above. The terms of this loan are substantively identical to the Installment Contract; in other words, the Seller will pay interest at the same interest rate as that required in the Installment Contract, and will owe a balloon payment for the principal amount of the loan in year thirty (30) to the Lender. This part of the transaction occurs immediately post-sale between the Seller and the Third Party Lender; and

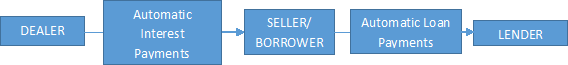

- Third Party Processor: The Seller utilizes a 3rd Party Payment Processor (hereinafter referred to as the “Processor”) to collect all incoming interest income from the Dealer for the course of the thirty (30) year Installment Contract. The Processor will deposit the interest income into an account established on behalf of the Seller, and will then pay all outgoing interest expenses owed to the Lender for the course of the thirty (30) year loan from the same account.

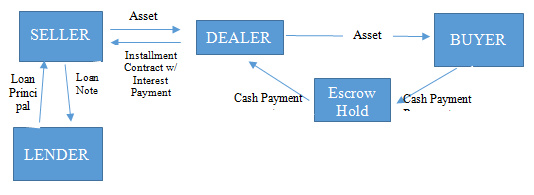

The entire transaction is summarized in the schematics illustrated in the diagrams shown below:

Part 1: The Installment Sale Transaction: (Seller Sells to Dealer / Dealer Sells to Final

Part 2: The Independently Provided Loan Transaction: (Lender offers Loan to Seller)

Part 3: The Third Party Payment Processor: (Each party engages in escrow instructions)

The Entire Installment Sale Transaction:

(Seller Sells to Dealer / Dealer Sells to Final Buyer)

A Few Specifics

Firstly, installment contract sales are the oldest method to buy and sell assets in the United States. The installment contract in this construct is an interest only, non-amortizing and non-reporting contract. The third party payment processor ensures that the installment contract interest payments are processed monthly directly from the intermediary to the Seller and from the Seller to the Lender. The Seller authorizes and instructs the Payment Processor to accept interest payments from the Intermediary and to send interest payments to the Lender, and the Intermediary/Dealer provides the Payment Processor authorization to withdraw payments. All interest payments are, therefore, timely made, for all parties to the transaction, and the Payment Processor provides an annual statement of interest income and interest expenses.

Secondly, each contract has a provision explaining that there are “no adverse effects” to or for the buyer. The final purchase of the physical asset is not affected in any way by the transactions between the Intermediary, the Seller, and the Lender. There are no additional mark-ups to the sales price, and all terms from the Buyer’s standpoint remain as agreed. In fact, the Seller actually delivers title to the asset directly to the Buyer.

Thirdly, the installment contract remains unsecured for the entire thirty (30) year period of the loan. The loan to the Seller is from a private lender (not a bank), and is not secured by the asset sold or the sale proceeds. The Lender agrees by contract to (a) not to report the loan to third parties (collection agencies, etc.); and (b) not to pursue default against the Seller in the event of third party default. The terms of the loan arrangement provide that the only recourse the Lender has is exclusively against the Intermediary in the event of default.

Lastly, the loan itself is a fixed rate, interest only, for the entire term of the loan. Payment of the Principal to the Lender upon at the close of the thirty (30) year term of the loan. Loan proceeds are immediately available to the Seller for re-investment, and no seasoning for the re-investment is required.

Example Scenarios

Summary Example 1

A home is being sold for a total purchase price of $2,700,000. Mr. & Mrs. Seller desire the home to enter into an installment sale transaction. The current debt associated to the asset is estimated at $0.00. For calculation purposes the assumed percent of tax is estimated at 30%. (When able to do so, the clients CPA or accountant is to provide a fixed dollar amount or percentage.) The price basis will be considered to be $500,000 since a standard deduction clause should be applicable. Based upon the estimate rate, the following estimated financial summary has been outlined:

| Standard Sale | Utilizing the Installment Sale | ||

| Sale Price | $2,700,000 | Sale Price | $2,700,000 |

| Debt: | $0.00 | Debt: | $0.00 |

| Acquisition Cost | $100,000 | Basis: | $500,000 |

| Federal Exemption | $500,000 | Seller: (Installment) | $2,700,000 |

| Basis: | $600,000 | Seller: (95% Loan) | $2,565,000 |

| Taxable Proceeds: | $2,100,000 | Future Taxes Due: | $660,000 |

| Tax Rate: | 30% | Closing Costs (1.5%): | $38,475 |

| Taxes Due: | $630,000 | Lender 1%+ Title .5% | |

| Loan Proceeds to Seller | $2,526,525 | ||

| Net Amount to Seller | $2,070,000 | (Approximate) |

Summary Example 2

A company owned by multiple partners is being sold for a total purchase price of $32,000,000. Mr. Seller owns 25% of the asset being sold and desires to enter into an installment sale transaction. The current debt associated to the asset is estimated at $3,500,000. For calculation purposes the assumed percent of tax is estimated at 34%. (When able, please have the clients CPA or Accountant provide a fixed dollar amount or percentage). Based upon the estimated rate, the following estimated financial summary has been outlined:

| Standard Sale | Utilizing the Installment Sale | ||

| Sale Price | $32,000,000 | Sale Price | $32,000,000 |

| Debt: | $3,500,000 | Debt: | $3,500,000 |

| Basis: | $0.00 | Basis: | $0.00 |

| Gross Proceeds: | $28,500,000 | Gross Proceeds: | $28,500,000 |

| Seller (25%) | $7,125,000 | Seller (25%):(Installment) | -$7,125,000 |

| Tax Rate | 34% | Seller (25%):(95% Loan) | $6,768,750 |

| Taxes Due: | $2,422,500 | Deferred Tax: | $2,422,500 |

| Closing Costs (1.5%): | $210,000 | ||

| Lender 1% + Title .5% | |||

| Net Amount to Seller: | $4,702,500 | Loan Proceeds to Seller: (Net) | $6,558,750 |

Based upon historical averages, it is estimated that by setting aside 20% of the “to-be-paid capital gain tax balance” in an interest bearing product obtaining equal to or greater than 6.5% interest or 5% net of tax, the balance will accrue over a period of 30 years to reach an amount greater than or equal to the tax amount due. A permanent life insurance product with a death benefit equal to the tax liability is, therefore, often recommended because the death benefit can fund the tax liability in the event the Seller dies before the tax comes due in year 30, or the cash value in the insurance policy can be used to pay the tax liability in the event the Seller is still alive at the time the tax comes due.

In this example, the set aside is estimated to be $484,500. This is only a hypothetical estimate which should be detailed and confirmed with the client’s financial advisor. (Note: If an adviser is needed to model and structure this type of investment, you may contact the writer for a referral). With the set aside amount factored in, the net loan proceeds to the borrower is estimated to be $6,074,250.

It should be noted that the amount set aside, as outlined above, will remain an asset of the borrower, although it is ear-marked for a singular purpose. It must also be noted that the lender is not interested in providing a consumer loan; it provides business loans which is why the lender requires confirmation that the funds will be re-invested. Having an entity (corporation, LLC, or other) in place would provide the borrower many options to reinvest the loan proceeds.

Concluding Thoughts

The system is NOT driven by Tax Deferral. It is a method for supplying less risky Financing Opportunities. It is, in essence, a Lending/Capitalization Strategy. In 2014 the system was utilized in a Federal Bankruptcy Case. Moreover, Third-party Legal Opinions have been provided for in the past pursuant to how each case applied the strategy.

In case you’re wondering, there is abundant education and support for the Parties involved in the Transaction, and there is ample access to experienced and reputable capital asset dealers (or lenders). Legal assistance for structuring and review of the transaction components is also available, and a referral network of Tax Attorneys for Opinion Letters is provided for each client.

As a parting thought, what the installment sale contract, as configured in this strategy, allows the Seller to do is to sell his asset today and then re-invest the sales proceeds on his/her own timeline! If the asset sold is real estate, this means that the Seller does not have to utilize a 1031 Exchange to re-invest in real estate, but instead may re-invest in real estate to the extent the Seller desires when the Seller Desires!